In today’s investment world, characterized by market uncertainties and fluctuating interest rates, finding a reliable avenue that balances risk and reward is crucial for investors. The Bajaj Finserv Multi Asset Allocation Fund emerges as a strategic solution for those seeking relatively stable returns amidst volatility. This fund offers a well-rounded approach to investment, designed to optimize returns while effectively managing risks. Let’s understand how this fund balances risk and reward through its unique investment strategies.

Bajaj Finserv Multi Asset Allocation Fund

Understanding multi asset allocation funds

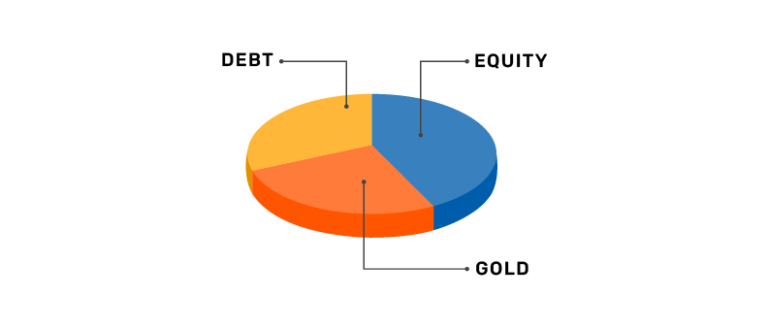

Multi asset allocation funds are designed to invest in a mix of asset classes – equities, debt, and commodities like gold-thereby diversifying the investment portfolio. This diversification helps mitigate risk while still providing opportunities for growth. Bajaj Finserv Multi Asset Allocation Fund is tailored particularly for conservative investors who prefer relatively steady returns, making it a suitable option in uncertain market conditions.

Equity allocation strategy

A significant aspect of the Bajaj Finserv Multi Asset Allocation Fund is its strategic approach to equity allocation. The fund focuses on investing in companies that demonstrate strong dividend growth, stability, and sustainable payout. By targeting equities that yield dividends higher than the Nifty 50 index, the fund aims to generate a consistent income stream for its investors.

The reinvestment of dividends is a key strategy in enhancing returns. By reinvesting these dividends, the fund utilizes the power of compounding, allowing investors to potentially accumulate greater wealth over the long term. This approach not only provides immediate income but also strengthens the portfolios growth potential, balancing risk and reward effectively.

Debt allocation strategy

Debt investments within the fund are designed to capitalize on opportunities throughout various interest rate cycles while managing associated risks. By adopting a short to medium-term investment horizon, the fund strategically positions itself to benefit from the yields available in the debt market.

During periods of interest rate hikes, the fund locks in higher yields, which optimizes income flow for investors. This proactive approach shields the portfolio from the adverse effects of rising interest rates, which can lead to bond price depreciation. Instead, investors enjoy relatively stable or increasing income streams.

Conversely, when interest rates decline, the fund can experience capital appreciation due to rising bond prices. This dynamic management of debt allocations allows the fund to adapt to market conditions, providing a layer of stability to the overall portfolio and ensuring that investors are safeguarded against interest rate fluctuations.

Gold allocation for diversification

Gold plays a crucial role in the Bajaj Finserv Multi Asset Allocation Fund, serving multiple purposes beyond mere diversification. Historically viewed as stable asset during times of uncertainty, gold also acts as a long-term wealth preserver.

Inflation hedge and currency stability

Gold’s intrinsic value makes it an effective hedge against inflation, maintaining purchasing power even as prices rise. Unlike currencies that may depreciate due to inflationary pressures, gold retains its value, making it a wise investment during such periods.

Additionally, in an interconnected global economy, currency fluctuations can impact investment returns. Gold serves as a hedge against currency depreciation, providing relative stability against adverse movements in fiat currencies.

Enhancing portfolio diversification

Incorporating gold into the multi asset allocation fund not only mitigates risks but also enhances overall portfolio diversification. Gold often exhibits low correlation with other asset classes, such as stocks and bonds. By including gold, the fund offers a more rounded portfolio capable of weathering diverse market conditions while optimizing risk-adjusted returns.

Ideal for conservative investors

The Bajaj Finserv Multi Asset Allocation Fund is particularly suitable for investors prioritizing low volatility in their investment journey. It caters to those aiming for long-term potential returns while minimizing downside risks. This fund is also an suitable option for first-time equity investors, providing a balanced approach to wealth creation without excessive exposure to market volatility.

Key benefits of Bajaj Finserv Multi Asset Allocation Fund

High dividend focus: By investing in companies with robust dividend payouts, the fund aims to generate a steady income stream, appealing to those seeking regular returns.

Mitigation of market volatility: Through diversification across various asset classes, the fund reduces the impact of market fluctuations, leading to a more stable investment experience.

Favorable taxation: The fund offers equity taxation on investments, which typically entails lower tax rates than debt investments, enhancing after-tax returns for investors.

Versatility across market conditions: Designed to adapt to different market environments, the fund navigates bullish, bearish, and volatile periods effectively, providing peace of mind to investors.

Balanced risk and reward: By spreading investments across multiple asset classes, the fund aims to balance the trade-off between generating returns and managing risk, creating a consistent investment experience.

Conclusion

The Bajaj Finserv Multi Asset Allocation Fund stands out as a prudent choice for investors looking to balance risk and reward in their portfolios. By strategically incorporating equity, debt, and gold allocations, the fund seeks to deliver steady returns while adeptly navigating market uncertainties. Whether you choose to invest through a systematic investment plan (SIP) or a lumpsum, this fund presents a well-rounded opportunity for those looking to secure their financial future with confidence. You can make use of tools such as SIP lumpsum calculator to decide the investment amount. In an ever-changing financial landscape, the Bajaj Finserv Multi Asset Allocation Fund remains a viable solution for achieving stability and growth in your investment journey.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.